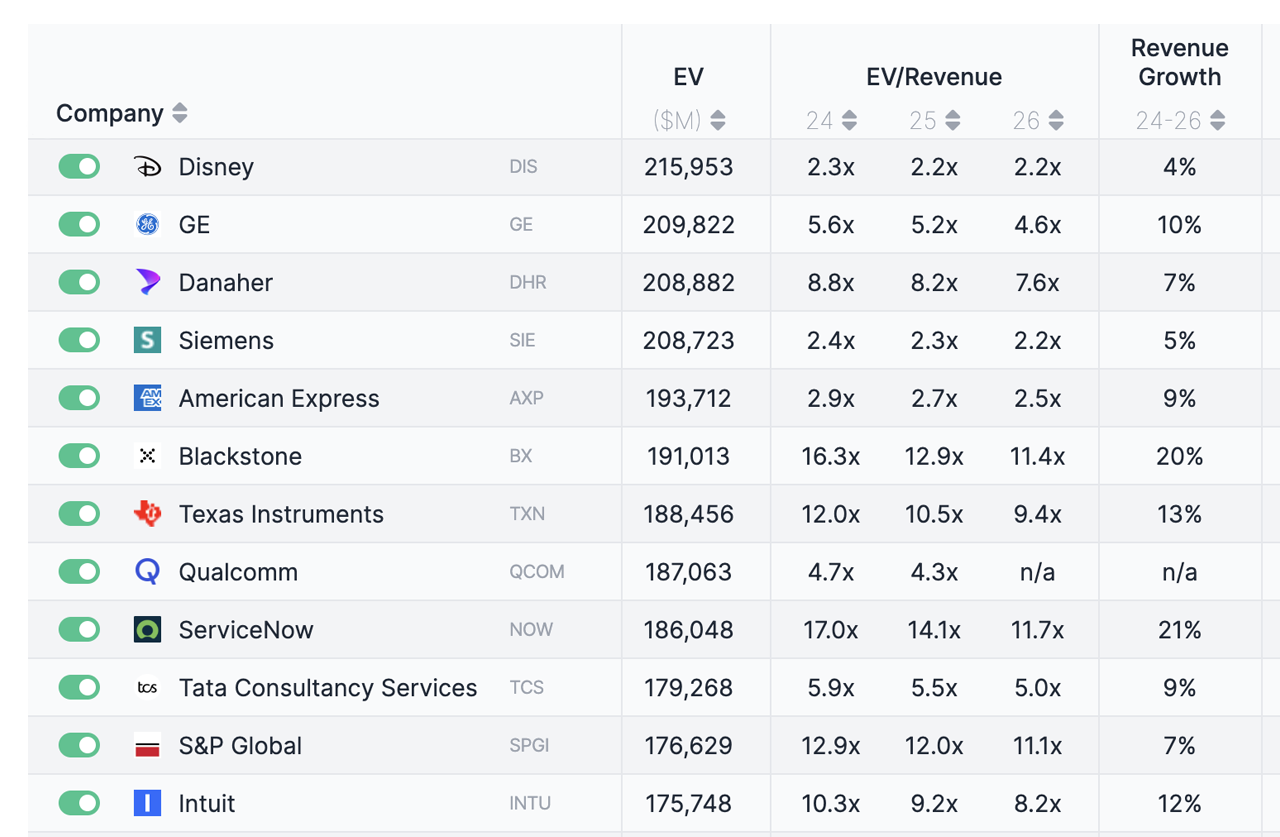

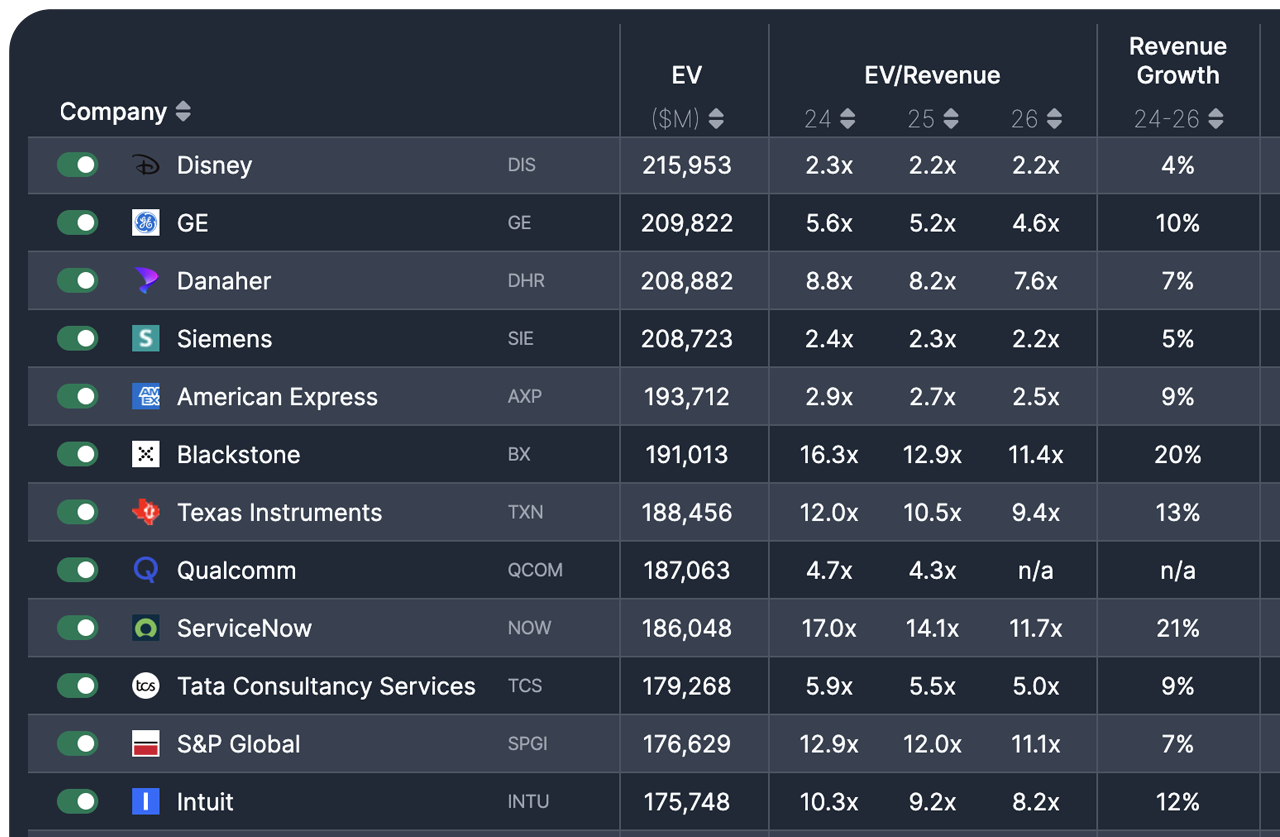

Benchmark Valuation Multiples, Public Comps, And Value Portfolio With Multiples

Access to investment-grade valuation data, tailor-made for for VC, growth equity and buyout investors. Benchmark public comps and forward-looking valuation multiples like EV/Revenue, EV/EBITDA and 50+ other key EV ratios.

and

and