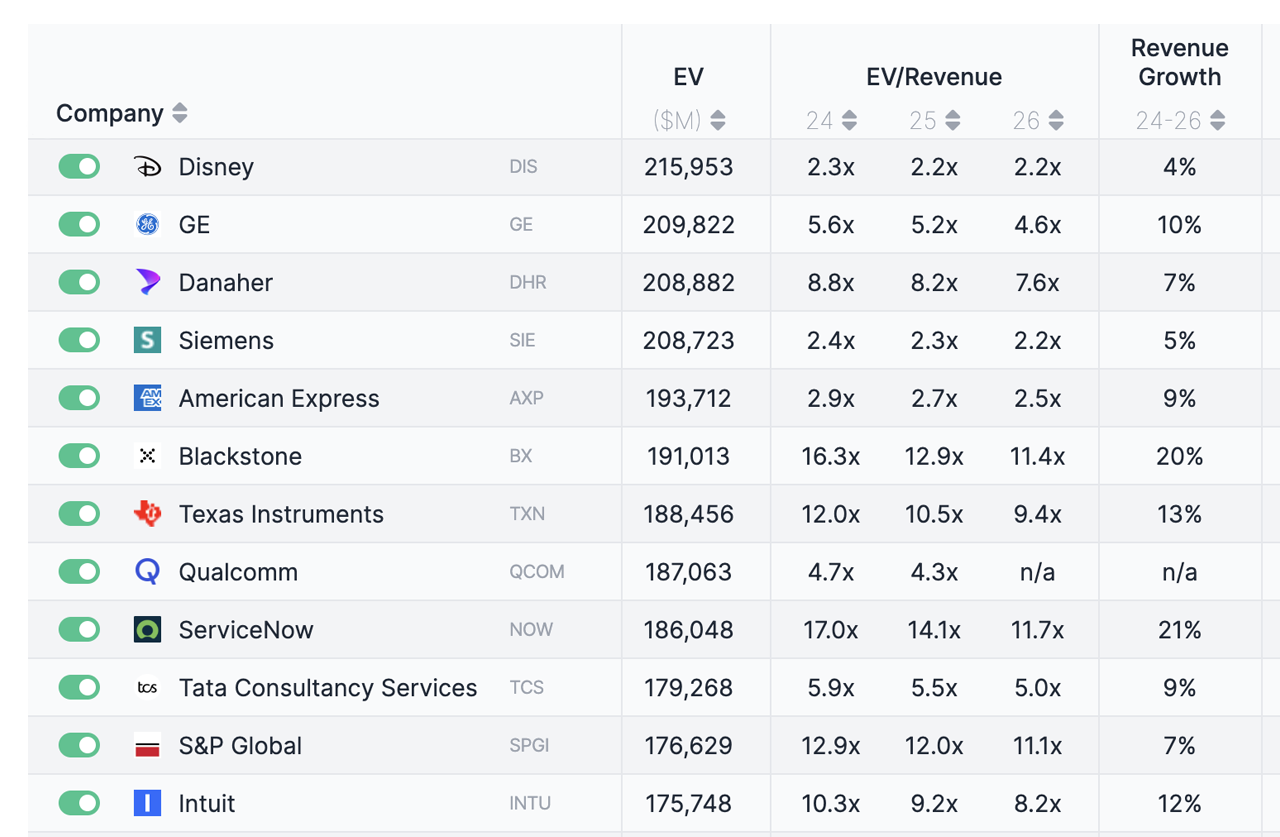

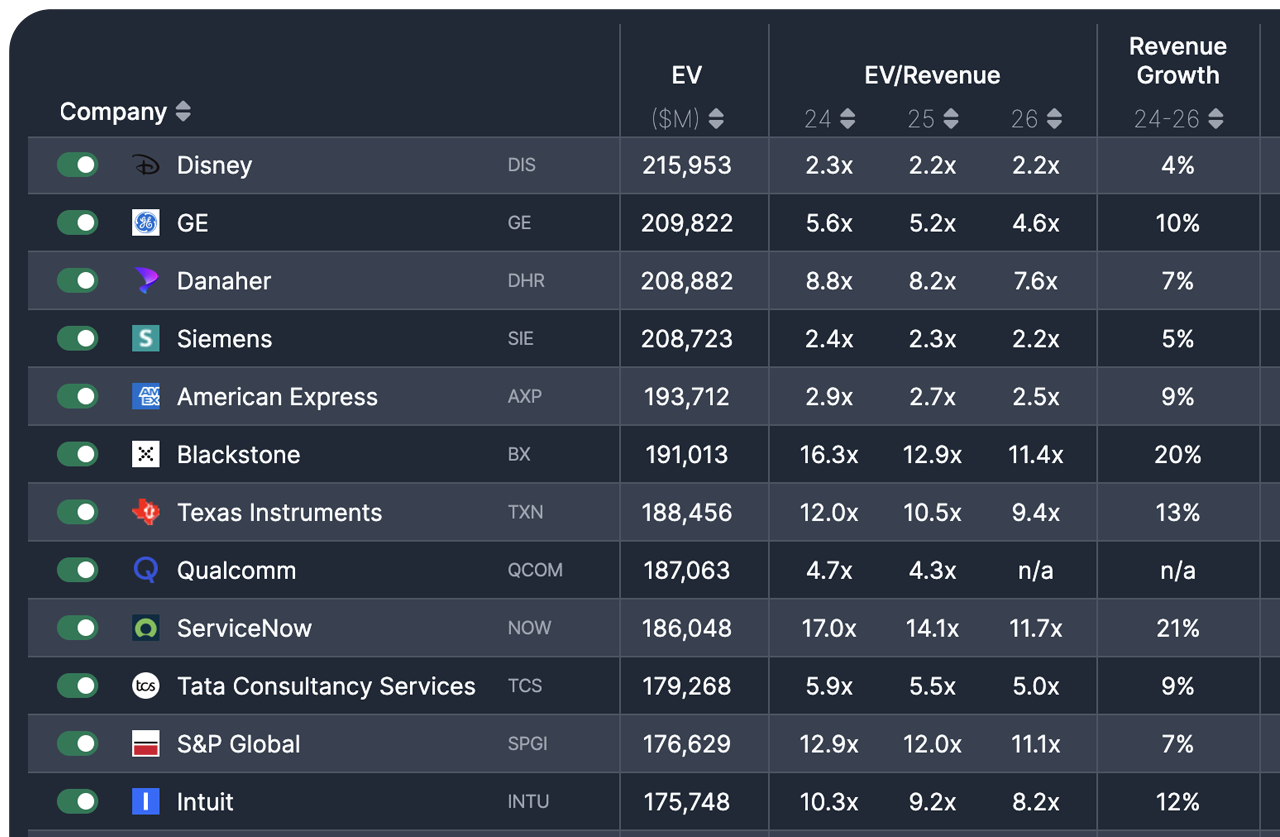

Integrate Valuation Multiples Data Within Fund Admin Software

Access investment-grade valuation data through a web app or an API, seamlessly integrated into your fund admin platform. Deliver valuation service to your clients based on the highest quality public comps and private comparables, powered by Multiples.

and

and