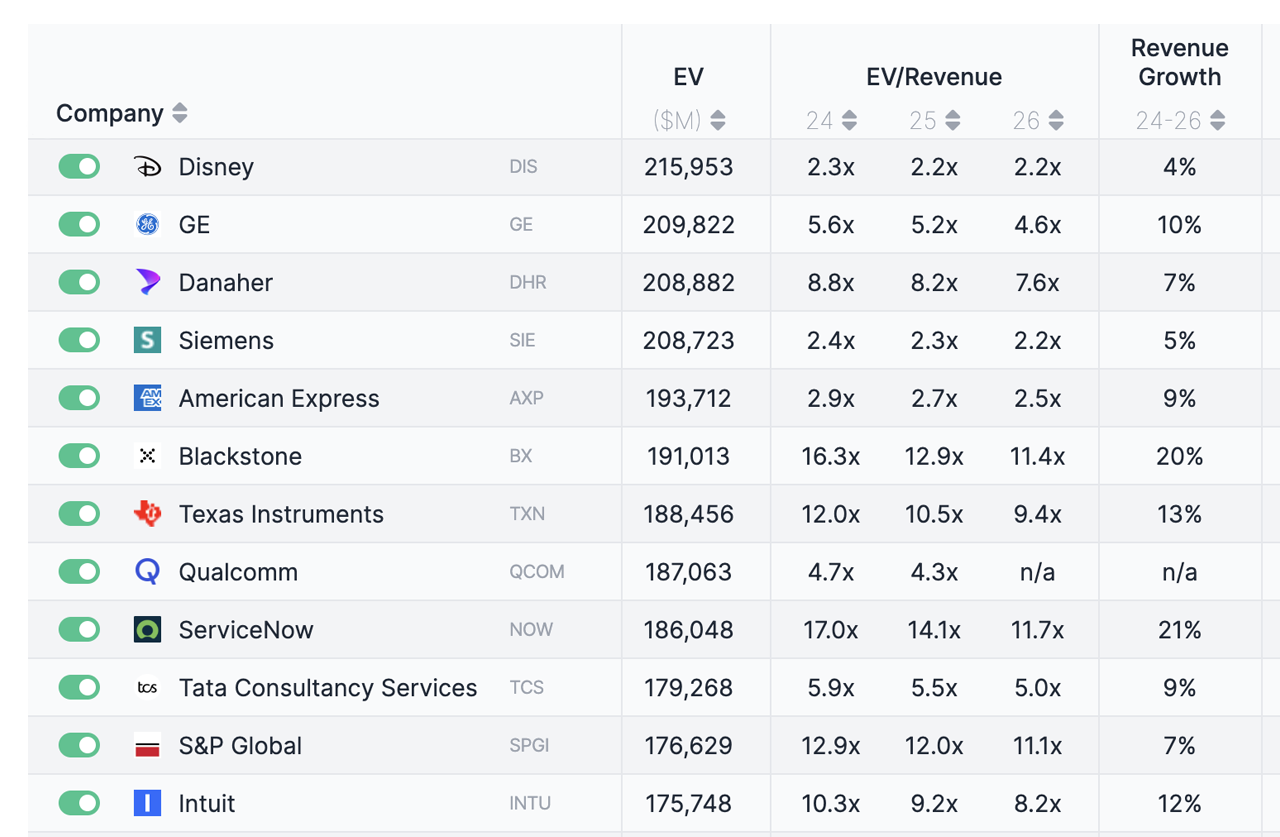

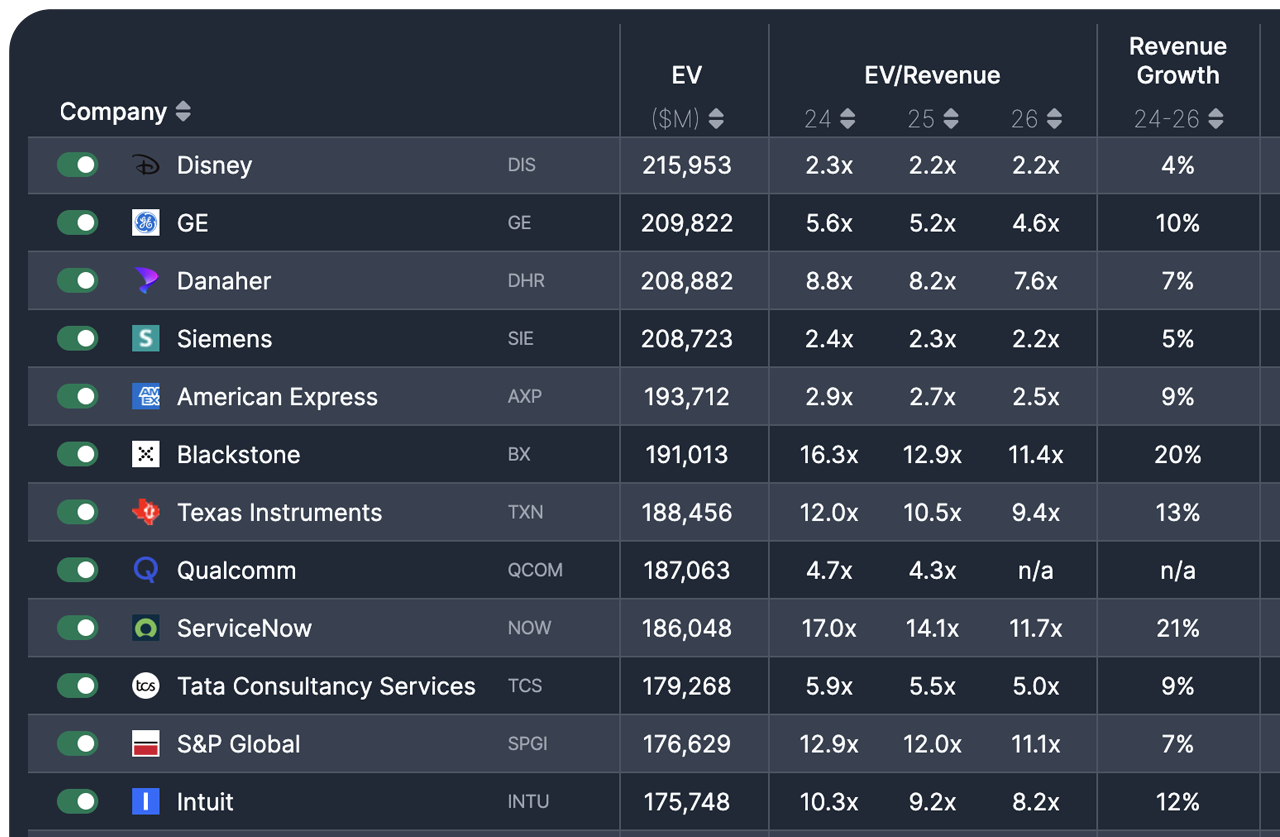

Get Valuation Multiples and Compare Your Business With Public Comps

Trusted by high-growth startups around the world, from seed to IPO, Multiples is a founder-friendly way to access high-quality valuation data. Find current valuation multiples in your sector, benchmark yourself to public comps and get verifiable data for accounting purposes.

and

and