Verified Analyst Estimates Data, No BS

You can trust the numbers. Our public comps and valuation multiples derived from analyst estimates are powered by FactSet and Morningstar, while transaction data is sourced through a combination of proprietary investment banking research, verified 3rd party providers and a community feedback system.

See more on dataMultiples is an absolute game-changer and saved me countless hours of analysis. User-friendly UI makes it incredibly easy to focus on metrics that matter the most.

Adam Hajer

Investor at Russmedia

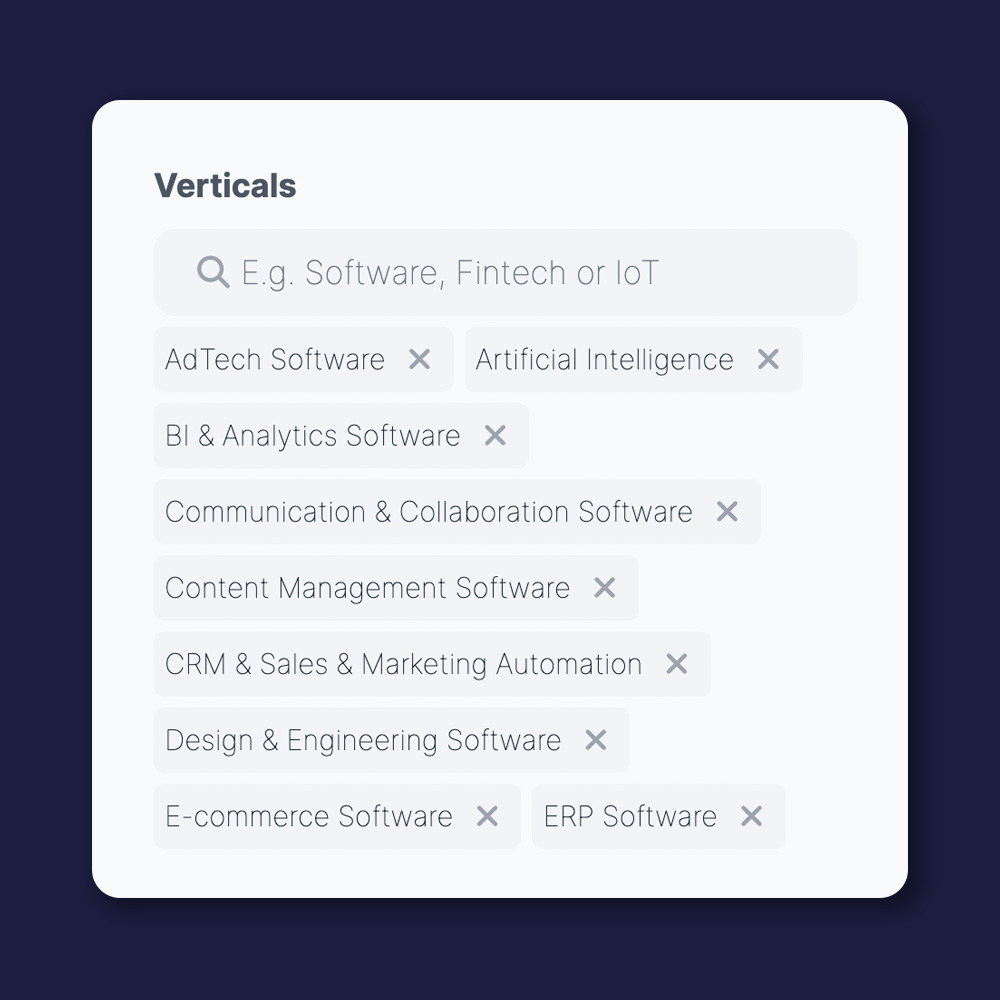

Sector Classification Built For Digital Age

We split comps into 220+ granular categories across all industry verticals, with a special emphasis on digital ecosystems. You can filter through tech themes like cloud infrastructure or B2B marketplaces as well as compare to offline sectors like agriculture or logistics.

See more on sectorsExtremely useful tool. I personally love the sector classification, which is much more updated and relevant to tech investors vs other tools in the market. It saves a lot of time!

Constanza Diaz

Investor at Octopus Ventures

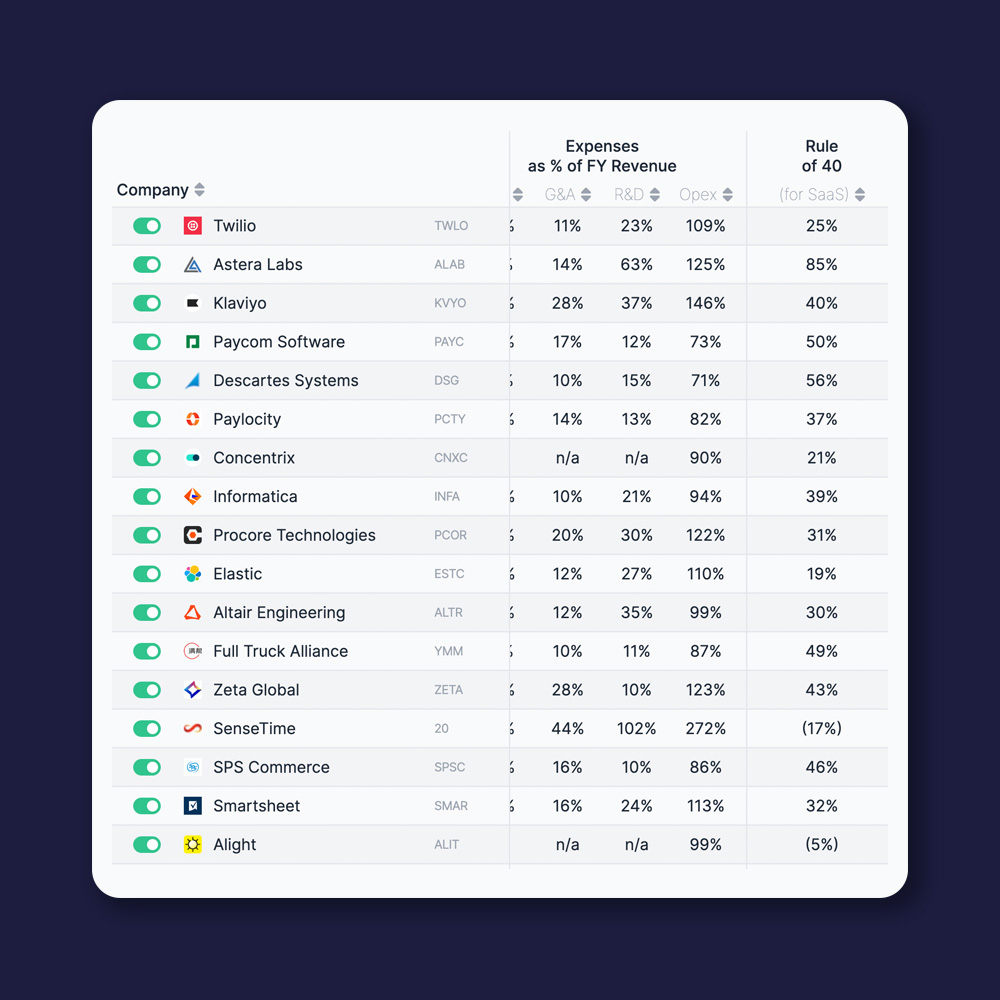

Find Tech-Specific Metrics That Matter

Valuation isn't just plain revenue or EBITDA. With Multiples you can benchmark tech-specific, niche metrics like rule of 40, growth-adjusted EV/Revenue, revenue per employee, or R&D expenses to sales ratio.

See more on valuation multiplesI like the simplicity and fluidity of the platform, and the killer part is really the "verticals" classification - super useful when trying to find comps that are actually relevant.

Victor Huberson

Principal at Partech

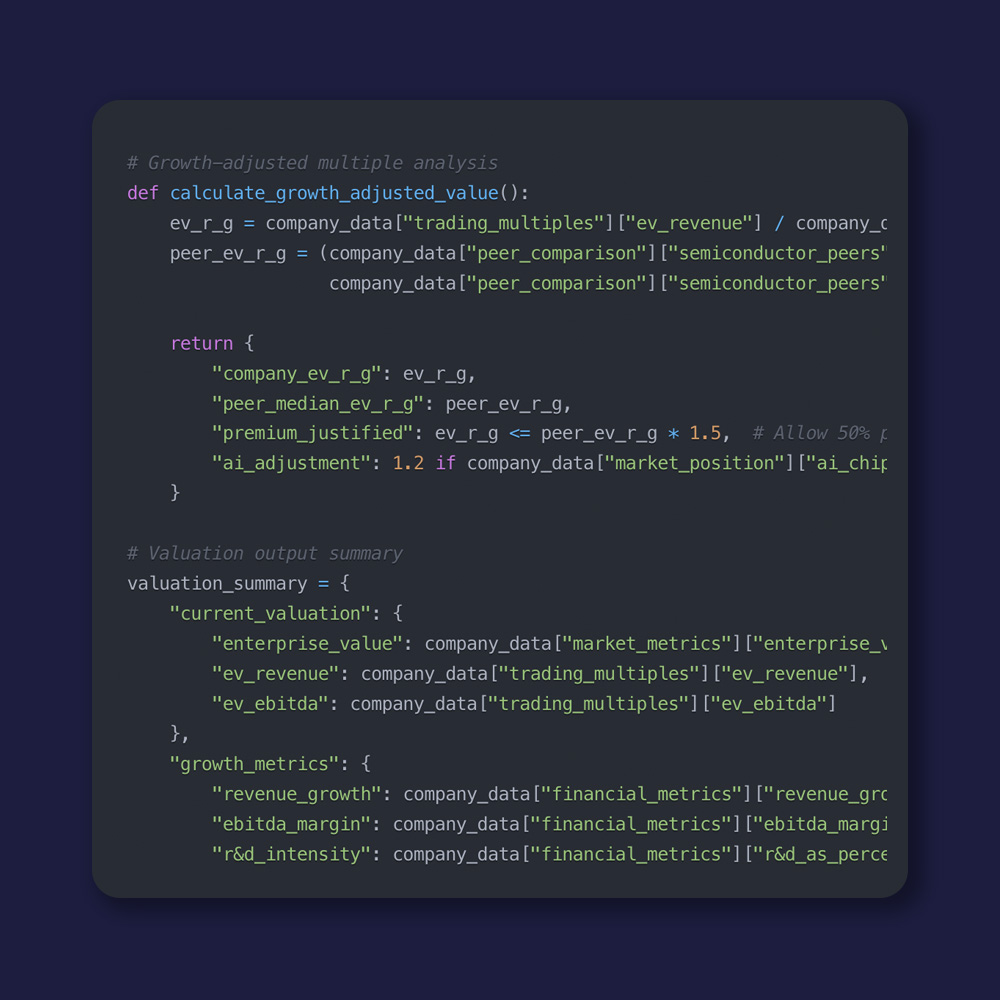

Integrate Valuation Data Into Your Workflow

Our API offering caters to institutional investors, fund administration platforms and other providers that require high-quality valuation data. Seamlessly integrate Multiples data within your product - significantly cheaper (and faster!) than with legacy data providers.

Learn more about APIFantastic tool for valuation analytics, unmatched data granularity. I love how accurate it is, super deep sector classification and modern UI. Makes my benchmarking very easy!